This is how I invest in stock using the MACD chart. Several years ago I purchased a stock that made me a lot of money when I really needed it. When I began buying stock I didn’t REALLY know what I was doing. Technically I was still “gambling” when I thought I was “investing”. There is a difference and I will explain that a little later.

This is how I invest in stock using the MACD chart. Several years ago I purchased a stock that made me a lot of money when I really needed it. When I began buying stock I didn’t REALLY know what I was doing. Technically I was still “gambling” when I thought I was “investing”. There is a difference and I will explain that a little later.

On to the good stuff. There was this stock that my friend Harry Sing told me about called Cannabix Technology Inc. (BLOZF). They are creating a breathalyzer that can detect THC for law enforcement. The stock price was $.47 per share at the time and I purchased 3191 shares (total: $1499.77) in October of 2017.

Sounds good right!? I thought it did. Now one of my friends still gets on me about buying the stock because of what it represents. I know I know… all we need is another way to put people in jail. Hey… I believe it will save lives. I’m sure my friends wouldn’t bitch if they made the money I did but that’s for another topic.

Three months later I sold my shares at $2.08 PER SHARE! That’s $5137.51 a 342.55% INCREASE! Yo!! I can get used to this! Then I was kicking myself for not buying more. Ugh! Anyway, this was an AWESOME return! Now if you’re reading this I’m SURE you want in on the action. I’m no financial expert but I will explain how I did it.

There was no trickery, no luck or any of that. I read a simple chart that told me when to buy and when to sell. You might think I’m full of crap but before I prove you wrong, we need to level set so it will all make sense. Let’s get to it.

Trading vs. Investing vs. Gambling

People use to tell me “investing in the stock market is nothing more than gambling”. If you’ve heard that before or you’ve said it before, you are not wrong! Now before you start to flip out, let me explain WHY you are not wrong.

Let’s define these terms, shall we?

- Gambling – “take risky action in the hope of a desired result.“

- Trading – “the act of engaging in trade.“

- Investing – “expend money with the expectation of achieving a profit or material result by putting it into financial schemes, shares, or property, or by using it to develop a commercial venture.“

Now that we are clear, let us move on.

If I want to gamble, I’ll just throw money at something and hope it turns out ok. That’s not very safe and is high risk. It’s either you win or you lose based on chance. End of story.

If I want to gamble, I’ll just throw money at something and hope it turns out ok. That’s not very safe and is high risk. It’s either you win or you lose based on chance. End of story.

I give you my salted peanuts for a glass of water you might or might not have.

Trading, on the other hand, is different. I see value in what you are giving me in return. There is not as much risk as it is with gambling because I have a metric. That metric is based upon what I see as valuable to me at that time.

I’ll trade you my salted peanuts for a glass of water. I’m thirsty, you’re hungry.

Investing however is me seeing value in what you provide and me offering you something to help you grow it and I will get the value if/when it grows.

You provide water and are hungry. I give you my salted peanuts so you can continue to provide and get more water. The more water you provide, the more water I drink.

Get it? Got It? Good!

Back to the story

I decided to INVEST in this company because I liked what they were doing. It made sense to me and they needed money to keep going so I invested with them.

OK so back to this chart thing!

The M.A.C.D.

M.A.C.D. stands for “Moving Average Convergence Divergence”. I like saying the full name because it makes me sound intelligent. This will tell me when to buy and when to sell. Granted there are many other charts, graphs, etc. that can help in the decision making but for this post, I’ll stick to this one.

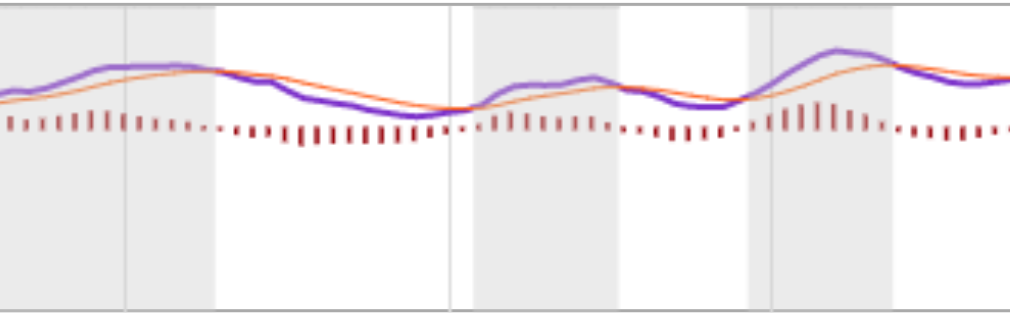

Purple line – 12 period (time) fast line … Orange line – 24 period (time) slow line

Here is the HIGH LEVEL / SIMPLIFIED explanation. The purple is the active trade line. The orange line is the trend. Start from the left.

When the purple line is going down, at the time it crosses the orange line, it’s time to sell. When the purple line crosses the orange line again (on it’s way up), it’s time to buy. Keep following that and the chart will tell you when to buy and to sell.

That’s it! I followed the MACD chart and purchased the stock on a downward trend when the line crossed at $.47. I sold it when the lines crossed again at $2.08.

BOOM!

Some Friendly Advice

If you are trading for the first time and are not a savvy investor or trader, DO NOT put money in the stock market you need to live on. DO NOT use your rent money, car payment, etc. That is stupid and the risk is not worth it. Trust me.

When deciding to take the leap, make sure you have your mind right and not all emotion because it sounds good. I recommend you read Rich Dad’s Cashflow Quadrant Book. It will help set you straight and make the risk feel more like a smart move and less like gambling.

Cheers!

Have you ever traded forex? That’s all about reading the MACD as well.

I haven’t. Going to check that out now. That MACD is the truth! Not the only way but a good way. Thanks for the heads up!